Deal Are Slipping Away

While your team spends 3-4 weeks manually reviewing loan pools, competitors with faster processes are winning the deals you should be closing.

Upto 30% fewer wins

You're Flying Blind

Sampling-based evaluations leave massive blind spots in your portfolio. Hidden risks in the unchecked loans could devastate your returns.

Upto 50% higher risk

Regulators Are Asking Hard Questions

Manual processes create inconsistent documentation and weak audit trails, making regulatory reviews a nightmare to defend.

Upto 40% more compliance issues

We've Solved This Problem for Leading Financial Institutions

CredStack was built by financial technology experts who understand the pain of manual due diligence because we've lived it.

Trusted by Banks

Leading institutions rely on our AI-powered platform

130+ Risk Parameters

Comprehensive credit, legal, and operational checks

100% Portfolio Coverage

No sampling gaps, complete transparency

AI reviews every loan, not just a sample

CredStack's AI delivers audit-ready, explainable results for every loan in your pool—no more blind spots.

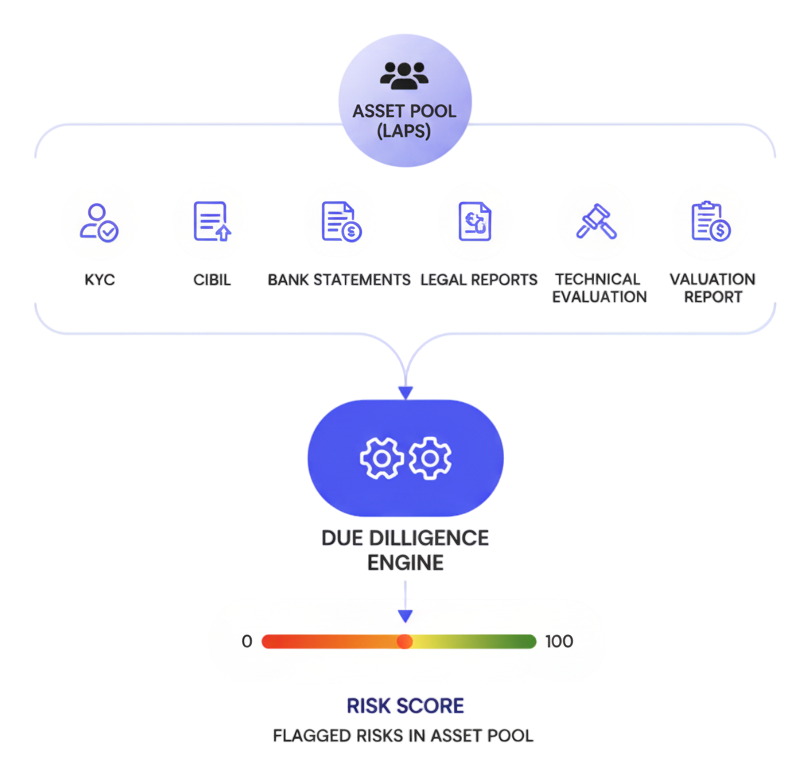

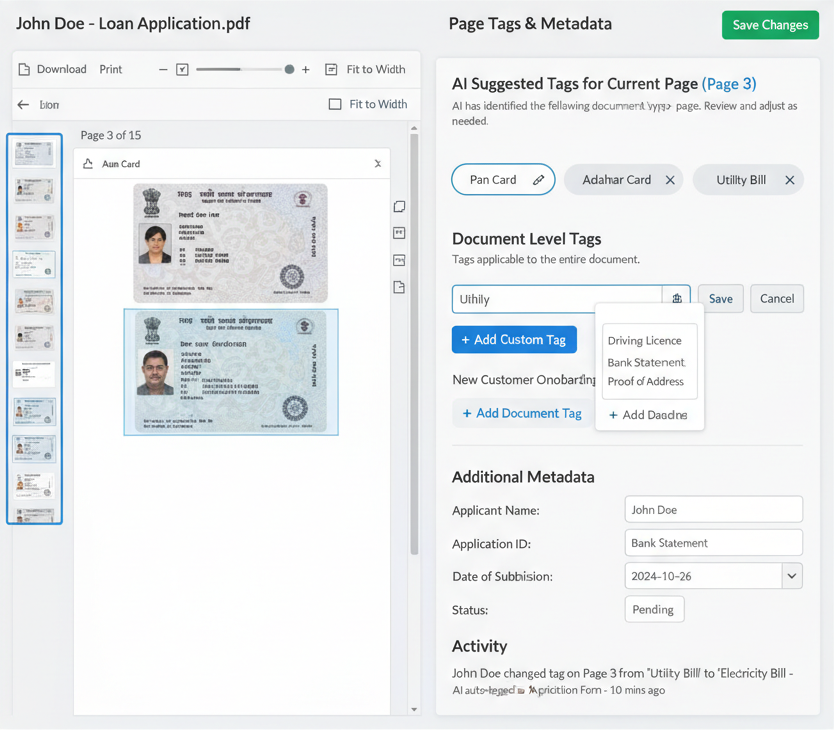

How CredStack Solves This

CredStack leverages AI to provide comprehensive loan coverage and insights, ensuring no risks are overlooked.

Extreme Performance

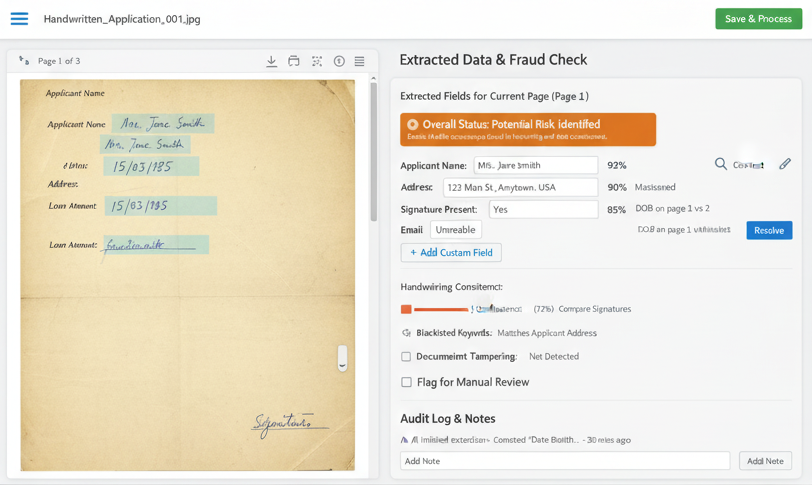

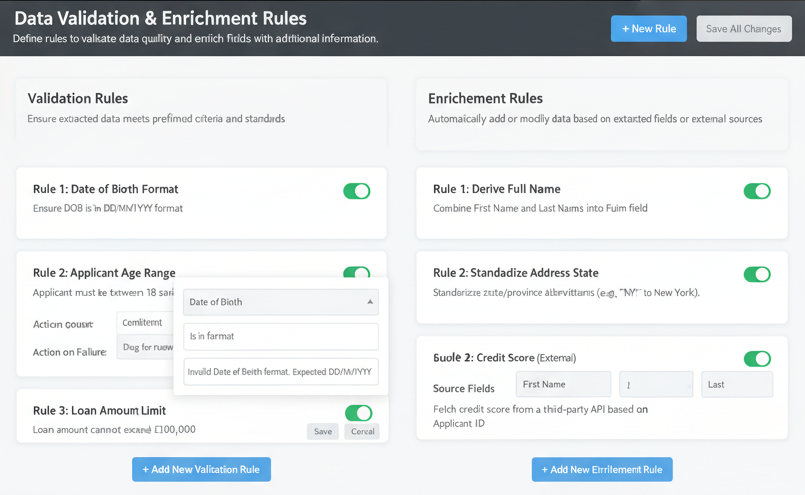

AI reviews 100% of your loan pool with 130+ parameter risk checks. No more sampling gaps.

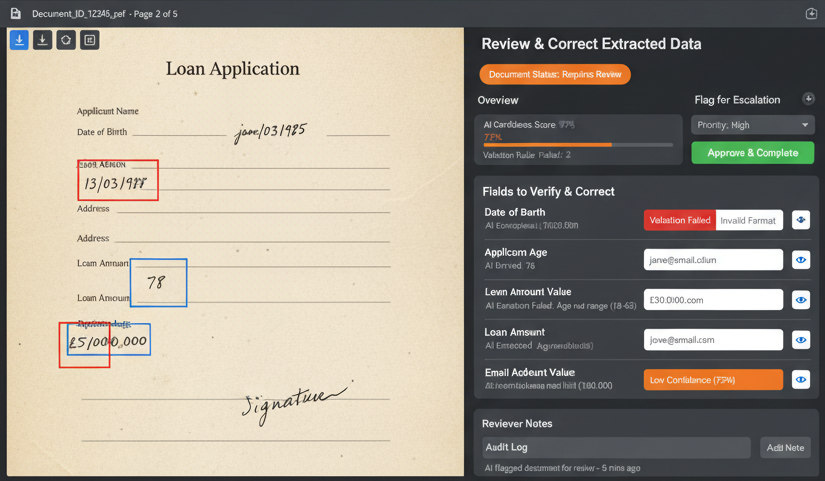

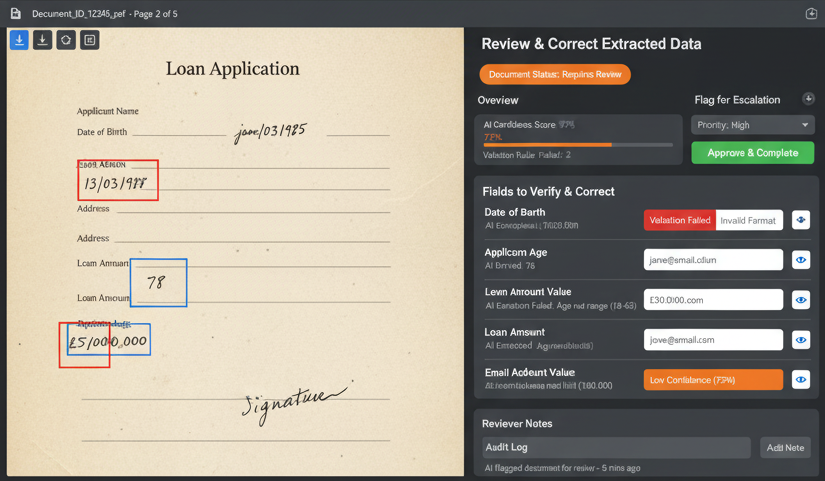

Explainable Risk Scoring

Get audit-ready reasoning for every decision. Transparent documentation for regulators and investors.

Continuous Monitoring

24/7 AI-driven monitoring. Detect fraud, duplicates, and borrower stress before they impact returns.

Seamless Integration

Plug directly into your existing LOS/LMS systems with our API-first design.

Download Whitepaper

Understand how AI can transform underwriting and securitization due diligence for DA and PTC deals.