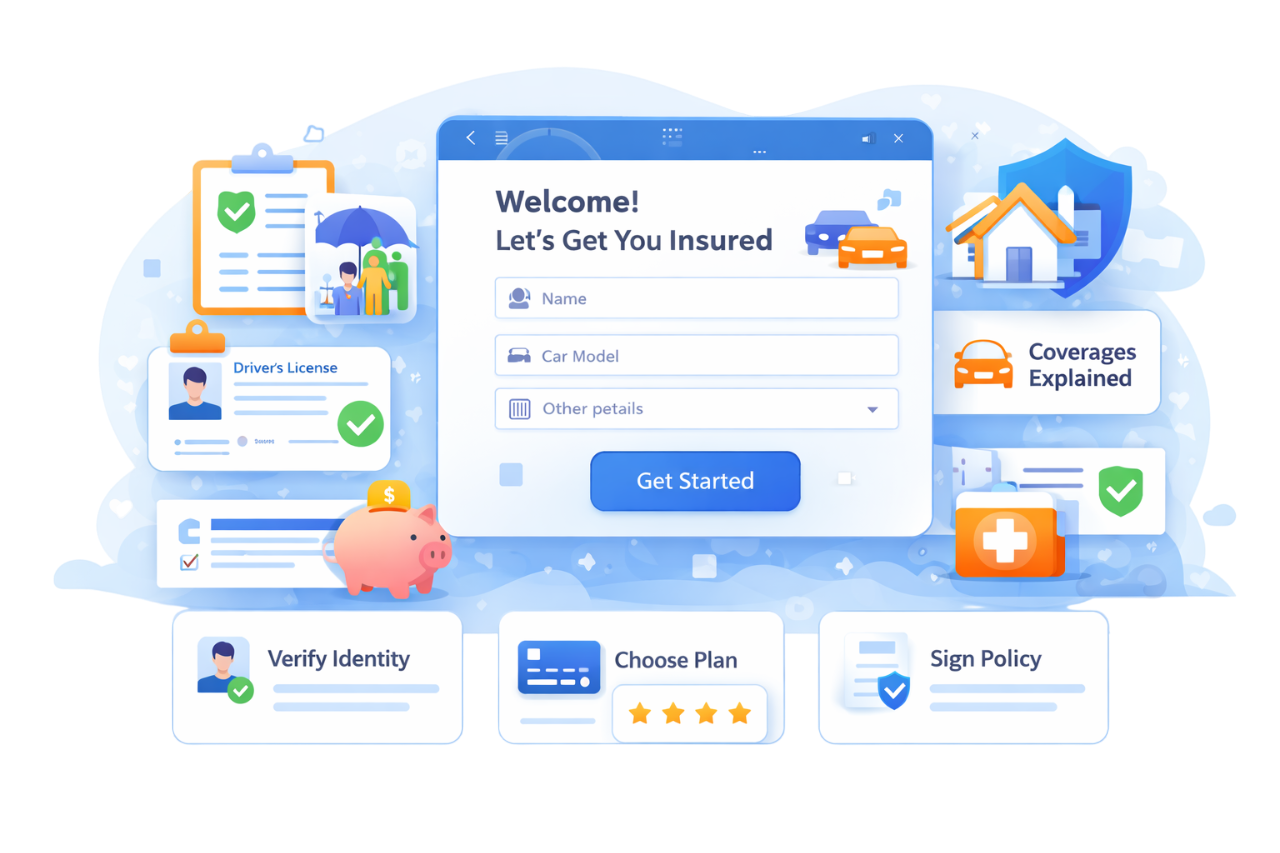

Eliminate Proposal Forms

Proposal forms slow down conversions — capture the same data through conversations and documents.

Higher conversion and cleaner submissions

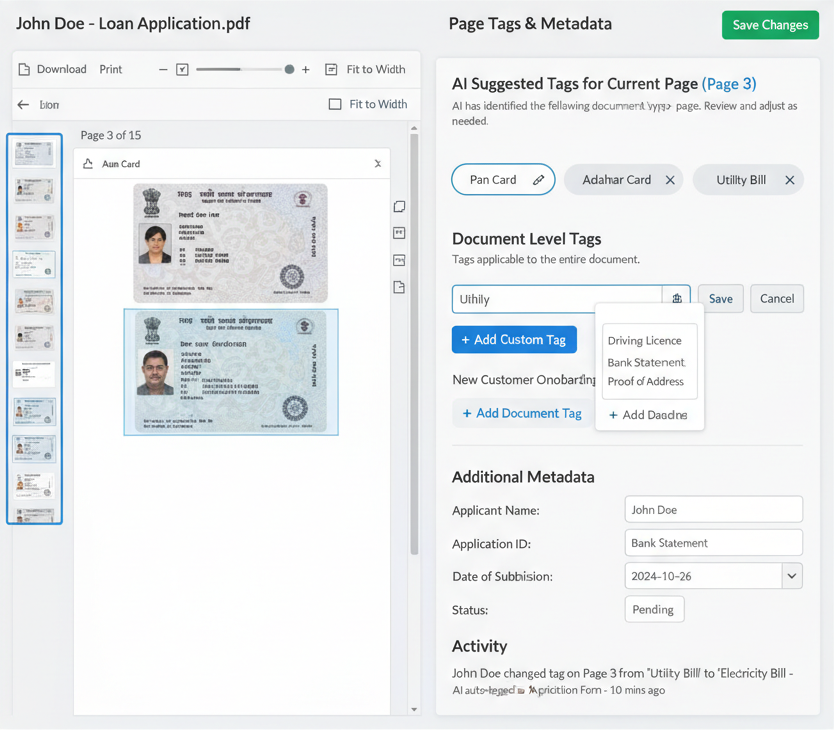

Early Risk Screening

Validate disclosures, KYC, and eligibility at sales to avoid underwriting rework.

Better underwriting efficiency

Automated Policy Communications

Automate proposal updates, medical requests, issuance notifications, and renewals.

Improved customer trust and compliance

Insurance Onboarding — AI-driven, No-Form, Compliant

Enable faster policy issuance with zero-form onboarding, automated risk checks, explainable underwriting, and compliant customer communications.

No-Form Proposal Intake

Capture proposer and risk data through conversation, uploads, or integrations — no proposal forms

Instant Risk & KYC Checks

Run eligibility, disclosures, and verification checks at the sales stage

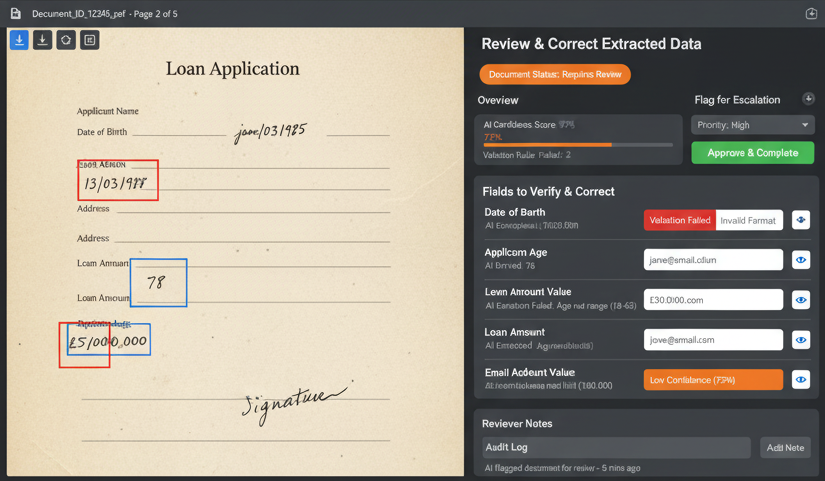

Connected Sales → Underwriting → Policy Servicing

A single audit trail across acquisition, underwriting, issuance, and renewals

Faster issuance, better risk control, compliant workflows

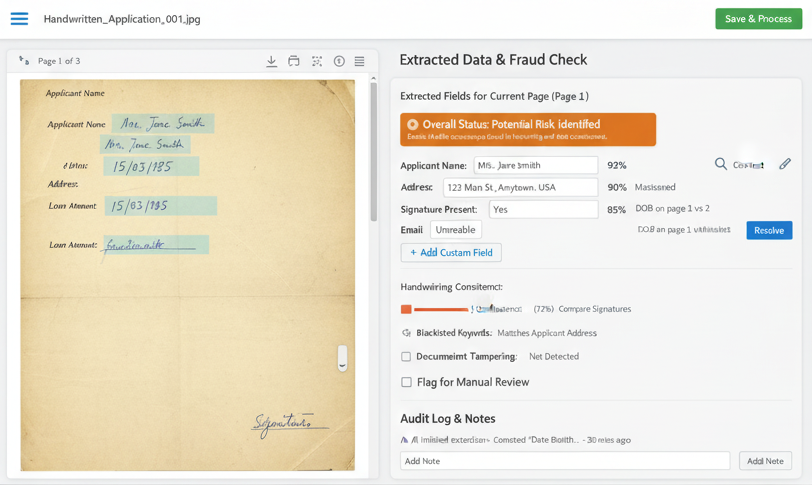

credstack converts sales interactions into underwritable insurance cases with automated checks, AI risk scoring, and audit-ready communication.

How credstack Solves Insurance Onboarding

credstack automates proposal intake, risk checks, underwriting preparation, and customer communications so insurers can scale without increasing risk.

Zero-Form Proposal Capture

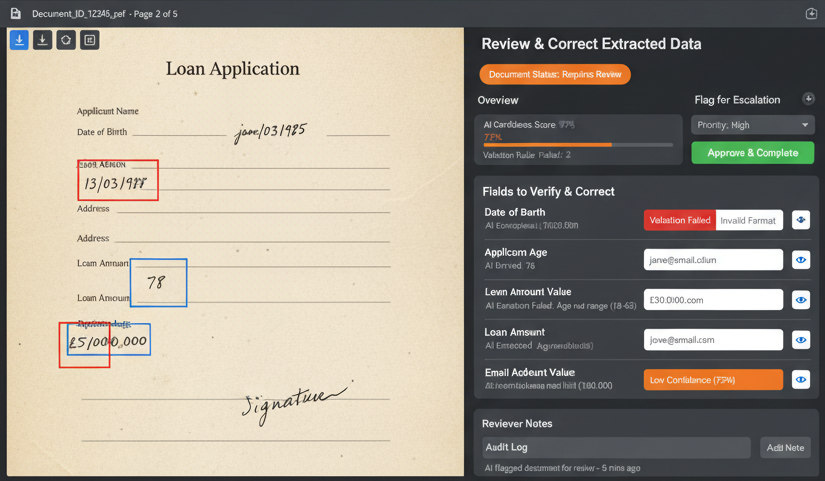

Eliminate proposal form friction by extracting data from conversations, documents, and digital channels.

Point-of-Sale Risk Validation

Run KYC, medical disclosures parsing, and eligibility checks before underwriting begins.

Underwriting Acceleration

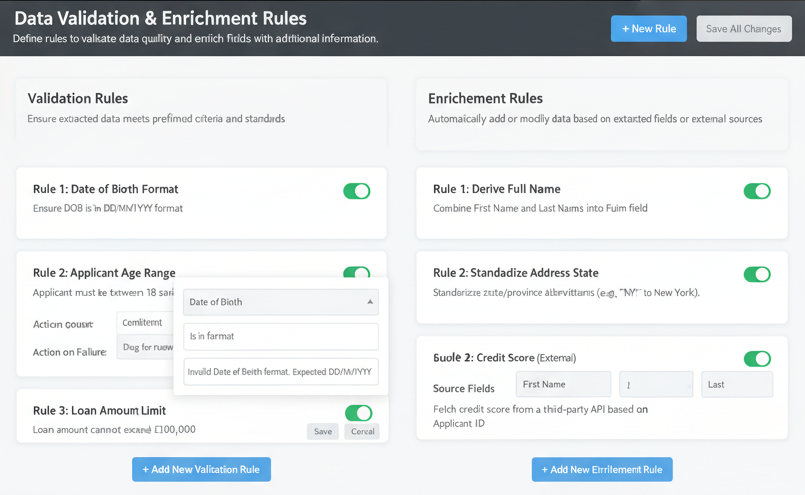

Auto-filled underwriting packs, configurable rules, and explainable AI decisions for faster issuance.

Automated Compliance & Communication

Trigger compliant customer communications with complete logs for audits and regulatory review.

Download credstack Insurance Onboarding Brief

See how credstack enables zero-form insurance onboarding, automated risk checks, underwriting acceleration, and compliant customer communications.