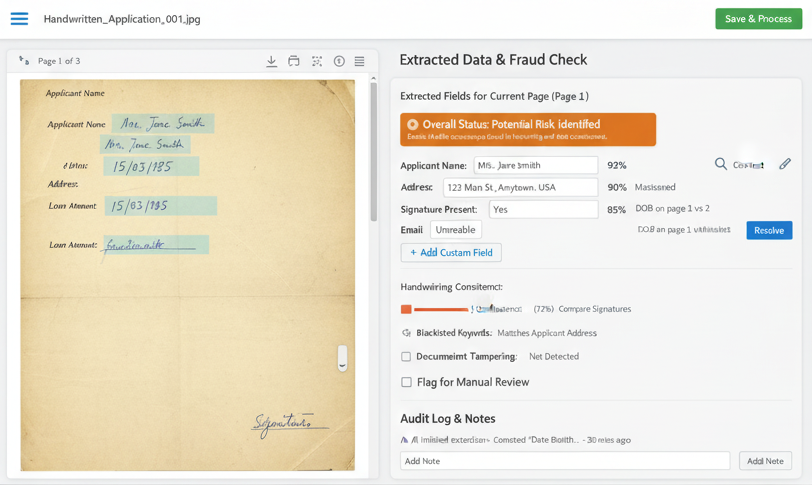

Validate Identity & Consent

Ensure proposer identity using photo matching and signature verification.

Lower fraud and misrepresentation

Automate Medical Review

AI reads medical records and lab reports to surface underwriting-relevant insights.

Reduced manual medical scrutiny

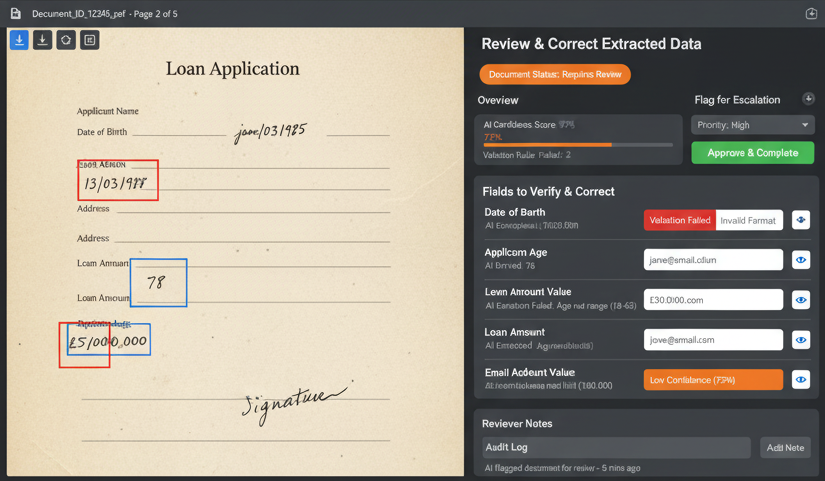

Explainable Decisions

Every underwriting outcome is supported by rules, evidence, and reasoning.

Higher regulator and reinsurer confidence

Insurance Underwriting — AI-driven, Evidence-first, Explainable

Transform underwriting with automated evidence validation, medical intelligence, and transparent risk decisioning.

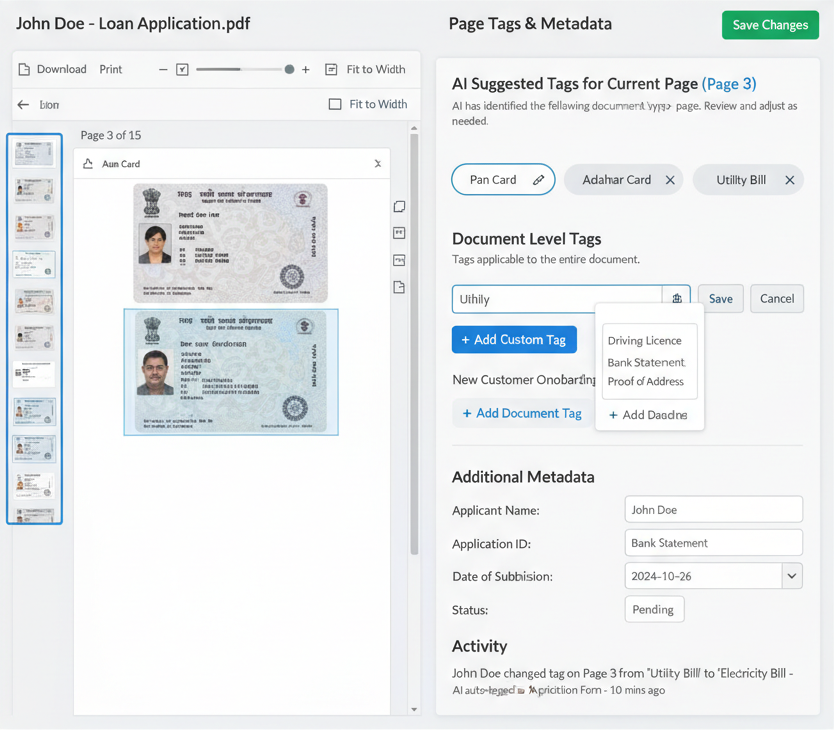

AI-led Evidence Processing

Photos, signatures, medical records, and inspections processed automatically

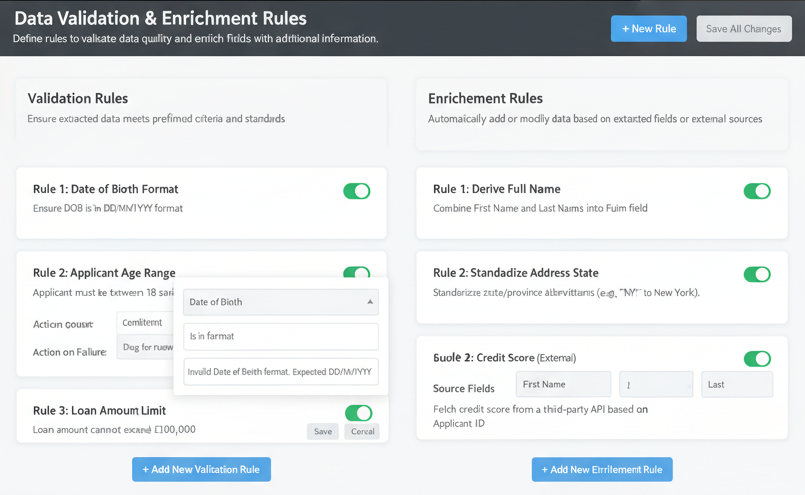

Configurable Underwriting Rules

Support insurer-specific guidelines, thresholds, and exclusions

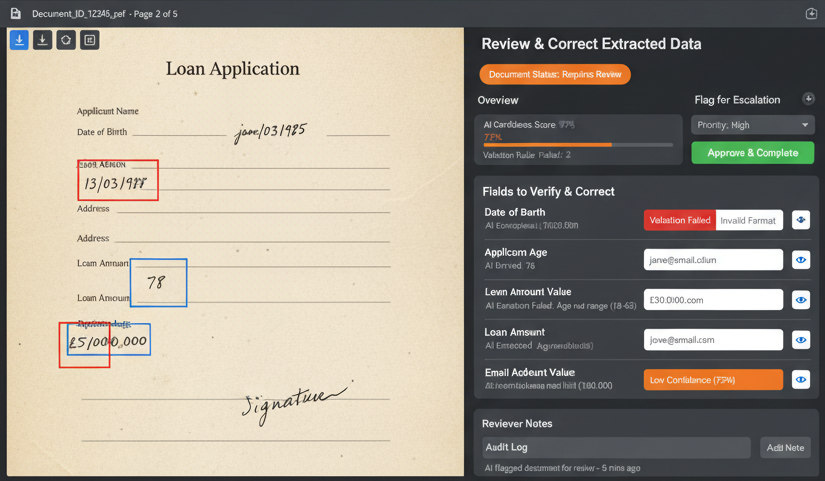

Human-in-the-loop Control

Underwriters can review, override, and justify decisions when required

Faster decisions without compromising risk

credstack enables insurers to underwrite at scale by automating evidence checks, medical analysis, and risk decisioning.

How credstack Powers Insurance Underwriting

credstack combines AI evidence processing, medical intelligence, and configurable underwriting rules to help insurers underwrite faster and safer.

Photo & Signature Verification

Validate proposer photos, live images, and signatures against IDs and proposal documents to prevent impersonation and fraud.

Medical Records Intelligence

Extract structured insights from unstructured medical reports, labs, and prescriptions using AI.

Explainable Risk Scoring

Combine rule-based underwriting with AI risk signals while maintaining full explainability.

Audit-Ready Underwriting

Every decision is backed by evidence, checks performed, and rules triggered — ready for regulators and internal audits.

Download credstack Insurance Underwriting Brief

Learn how credstack automates photo, signature, and medical validation to deliver faster, explainable underwriting decisions.