Remove Manual Forms

Forms create friction at the point of sale — capture the same data through conversation, document upload, or channel ingestion.

Faster conversions and fewer drop-offs

Instant Due Diligence

Perform KYC/KYB, sanctions checks, and data extraction as soon as sales data is captured to avoid rework.

Higher-quality leads forwarded to underwriting

Automated Communications

Automate confirmations, KYC requests, and status updates across SMS, email, WhatsApp and voice with full logging.

Better customer experience and compliance

Banking Onboarding — AI-powered, No-Form, Audit-ready

Deliver zero-touch onboarding that moves deals from sales to underwriting and collections with automated due diligence, explainable scoring, and compliant communications.

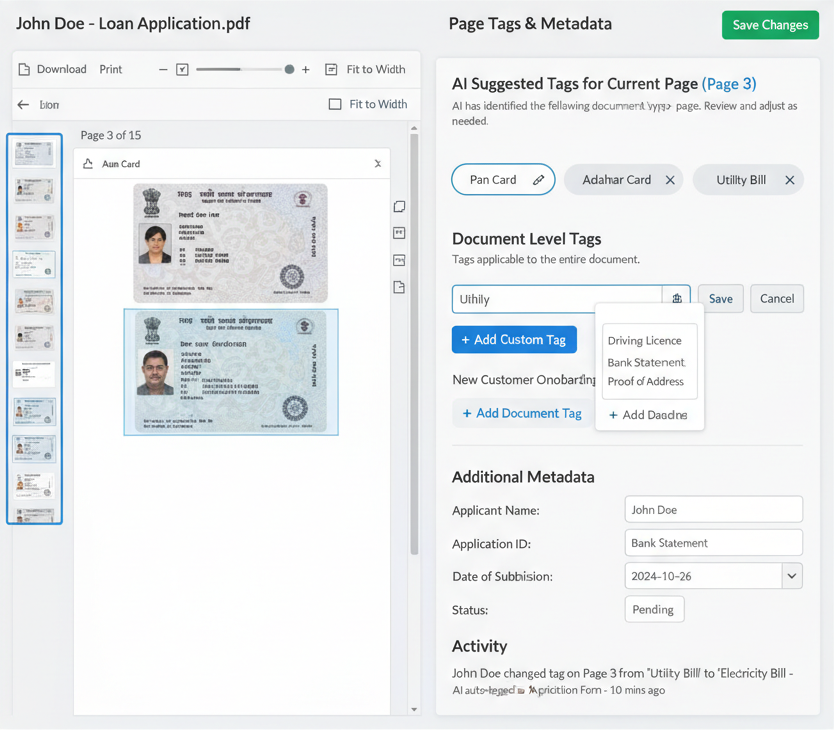

No-Form Data Capture

Collect borrower data through conversation, uploads, or channel ingestion — remove manual entry from the workflow

Instant Point-of-Sale DD

Run KYC/KYB and verification checks immediately to filter out ineligible cases early

Connected Sales → Underwriting → Collections

A single audit trail that follows the borrower across sales, decisioning, and servicing

Zero-touch onboarding, faster decisions, compliant comms

credstack transforms sales data into underwritable files with automated DD, explainable scoring, and audit-ready communications.

How credstack Solves Banking Onboarding

credstack eliminates form friction and automates due diligence, underwriting prep, and customer communications so banks can scale acquisition while remaining compliant.

Zero-Form Onboarding

Eliminate manual form entry by capturing data from conversations, documents, and channel inputs with intelligent extraction.

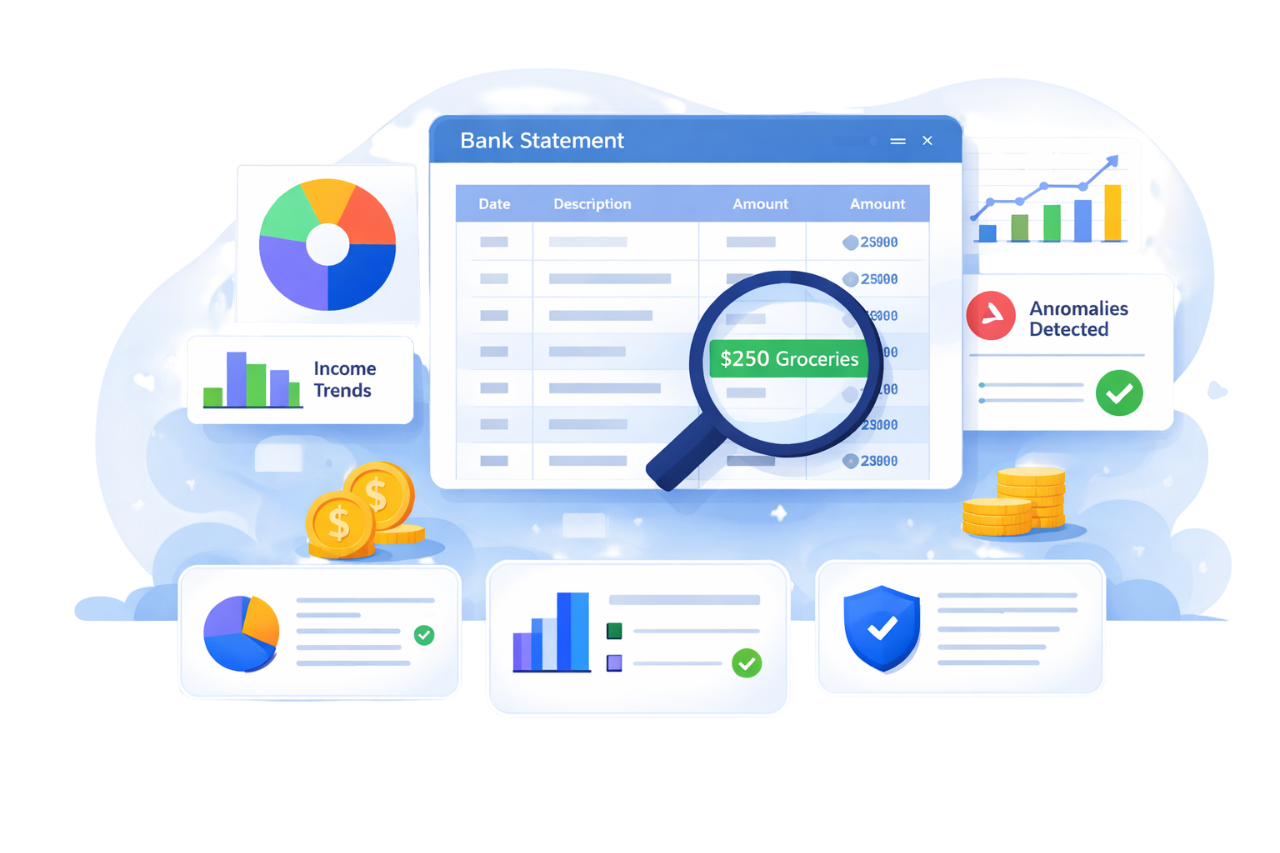

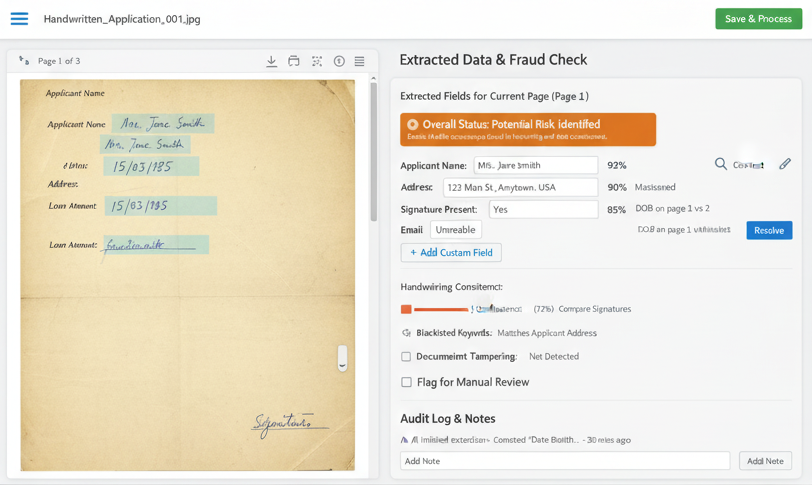

Auto Due Diligence at Point-of-Sale

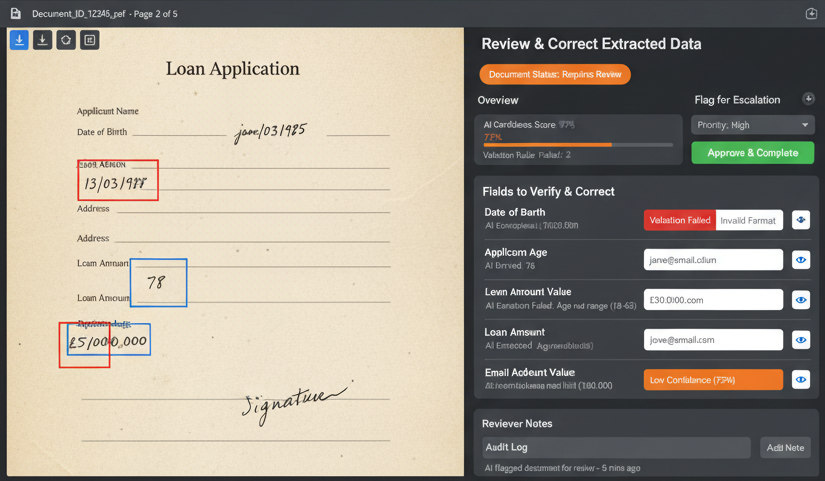

Run KYC/KYB checks, sanctions screening, and document verifications instantly at sales to prevent downstream delays.

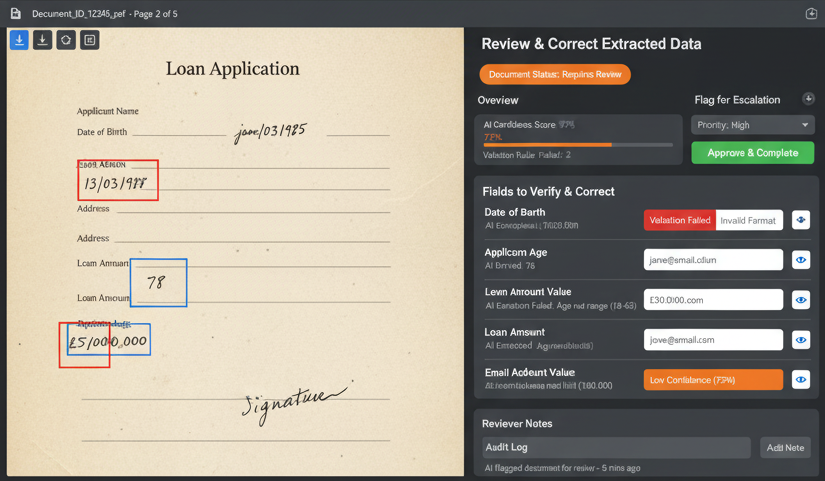

Underwriting Acceleration

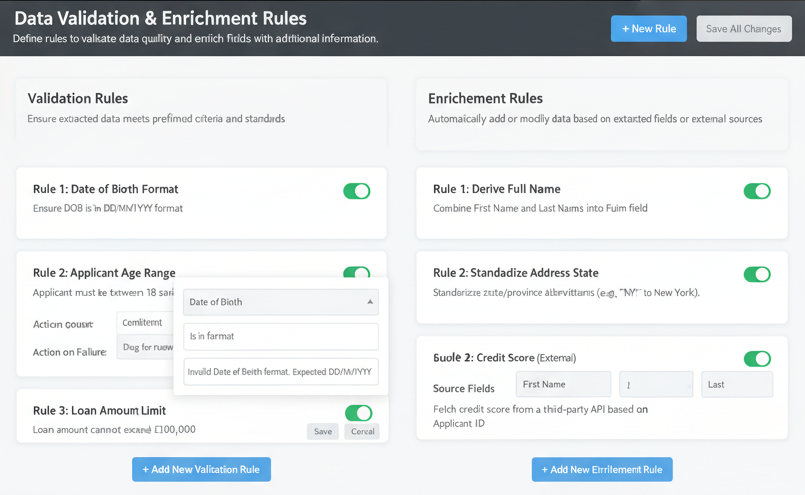

Pre-populate underwriting packs, apply configurable rule engines and ML scores, and produce explainable decisions for faster approvals.

Auto Communication & Workflows

Automated, configurable customer messaging across channels with templates, triggers, and full audit trails for compliance.

Download credstack Banking Onboarding Brief

See how credstack enables zero-form onboarding, instant due diligence at sales, underwriting acceleration, and automated communications across the customer lifecycle.