Regulatory Complexity

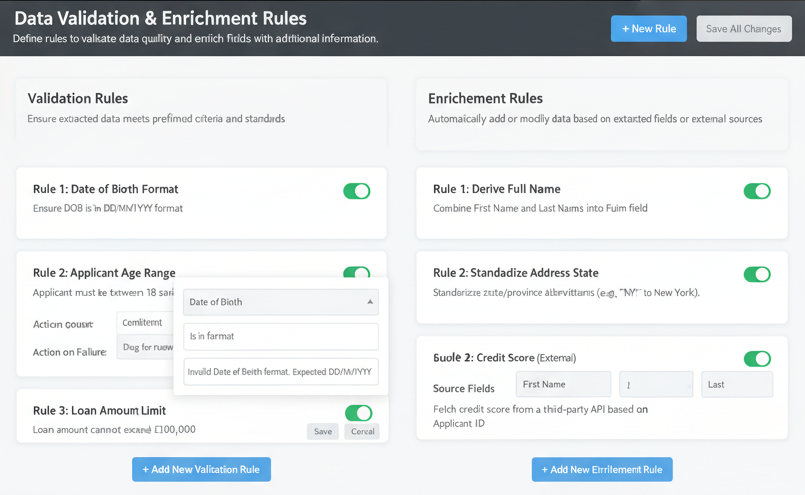

RBI co-lending rules require auditable processes for splits, disclosures, and reconciliation — manual processes struggle to keep up.

Higher compliance risk if unmanaged

Slow Partner Onboarding

Manual KYC and document checks slow down deals. Automating these steps captures more business without increasing headcount.

Loss of time-to-market

Reconciliation Pain

Handling cancellations, corrections, and periodic reconciliations across two books (originator & lender) is error-prone without automation.

Operational overhead & disputes

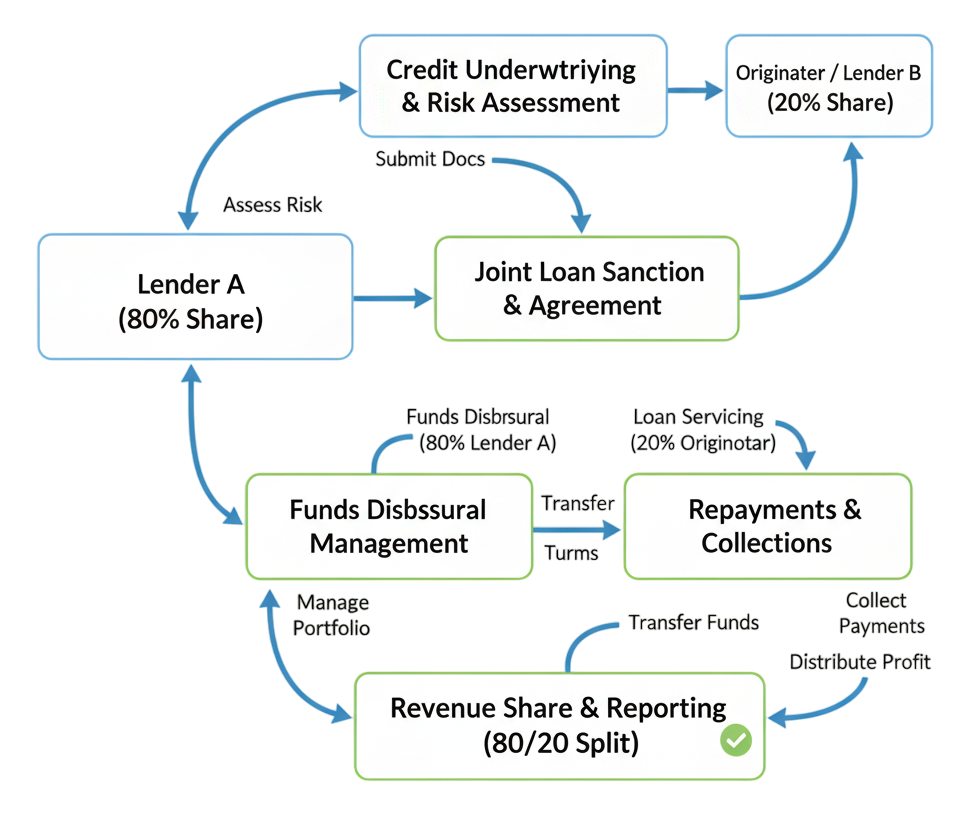

Co-Lending — Compliant, Auditable, and Automated

credstack implements RBI co-lending rules and operationalizes the entire co-lending lifecycle — from onboarding to portfolio reconciliation.

RBI Compliance

Adopts the most recent RBI guidelines for origination and lender splits

Configurable Split Templates

Support for common divisions like 80:20 and 90:10, plus custom allocations

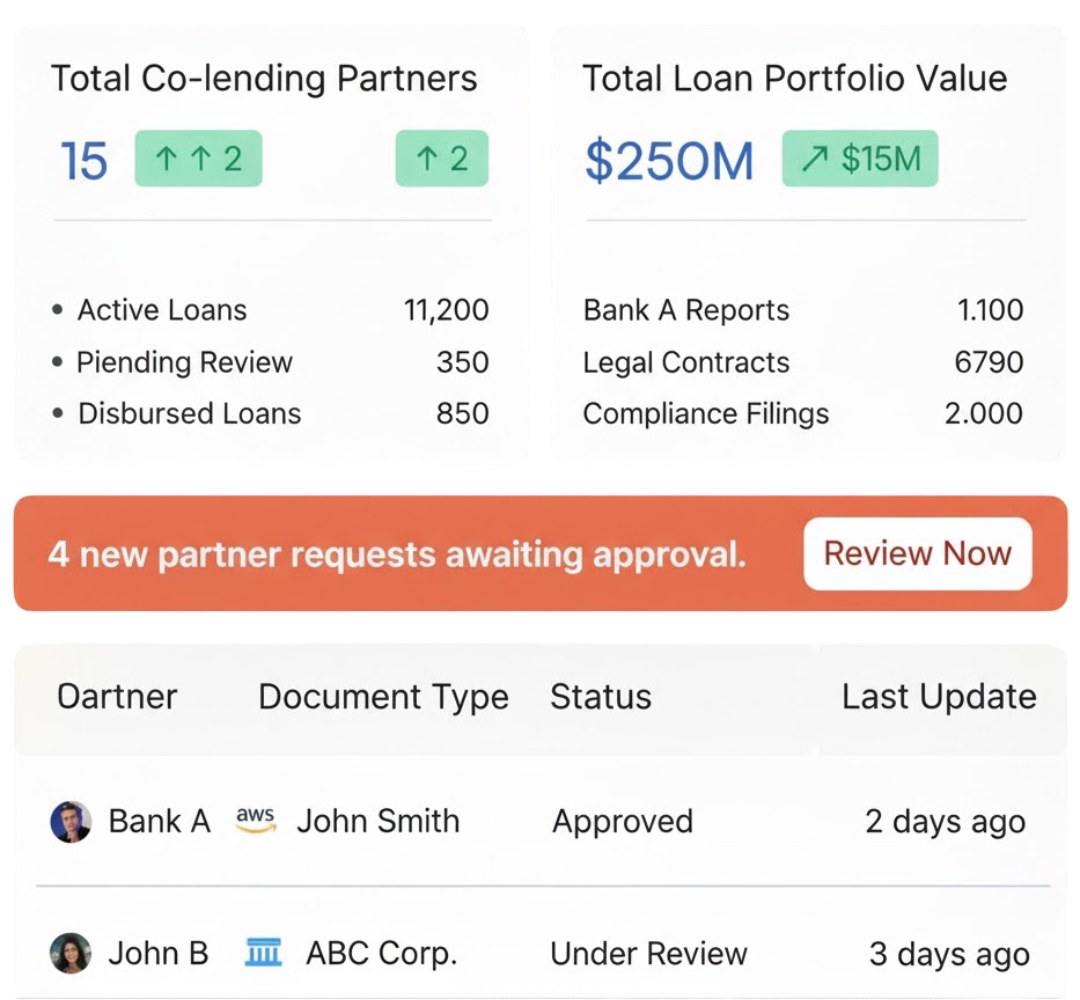

Unified Partner Portal

Role-based access for originators and lenders with clear responsibilities and views

Compliant co-lending, faster onboarding, clearer oversight

credstack automates splits, validations, and portfolio management so originators and lenders can scale co-lending with confidence.

How credstack Solves Co-Lending Challenges

credstack brings RBI-aligned automation to the entire co-lending lifecycle — allocation, onboarding, validation, recancellation, and ongoing monitoring.

RBI-Ready Split Management

Pre-configured split templates (80:20, 90:10 etc.) and customizable allocation rules to match the latest RBI co-lending guidelines.

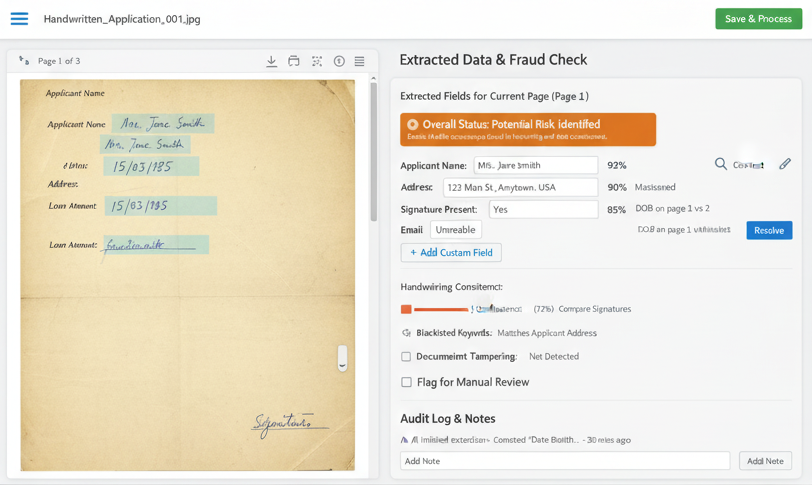

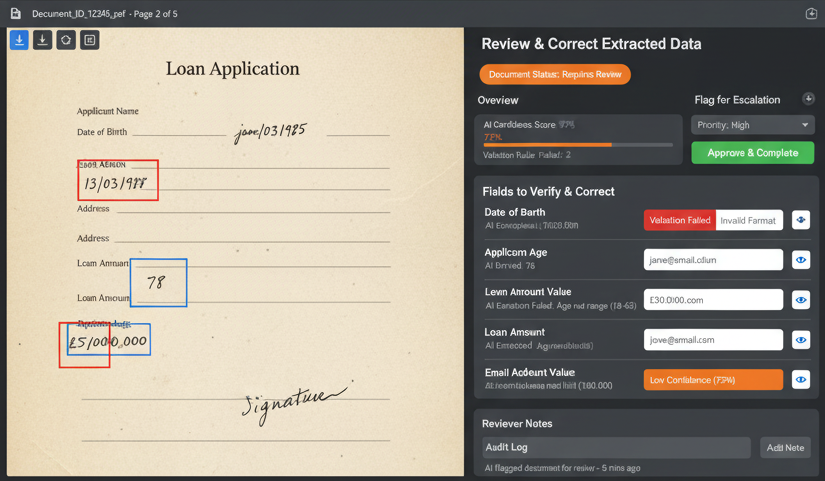

Automated Due Diligence

End-to-end automated checks (KYC/KYB, document extraction, rule validation) that reduce manual effort and speed up deal onboarding.

Recancellation & Reconciliation

Built-in recancellation workflows and periodic reconciliation between originator and lender books with clear audit trails.

Continuous Portfolio Monitoring

24/7 monitoring for fraud, duplicates, and borrower stress — with explainable scoring to support investor reviews.

Download credstack Co-Lending Brief

Learn how credstack helps originators and lenders operationalize compliant co-lending programs with automation and audit-ready workflows.